On the other hand, If you’re working in a salaried position, your pay will always be a fixed amount. While taking care of their interests, they also need to give due consideration to the state regulations. In many states, there are regulations about how often the employees need to be paid. Thus, it is important to check the frequencies of payment in different states before arriving at the final decision. Choosing the right pay schedule is a crucial decision for any organization, be it a large enterprise or SMB. It can determine the type of talent you attract and the long-term expenses you incur as a business.

However, semimonthly payroll schedules also have their disadvantages. Before choosing, keep in mind that states regulate how often you must pay employees. You might not be able to use biweekly or semimonthly pay frequencies in certain states. Check with your state before choosing how often you run payroll. Knowing the difference between biweekly vs. semimonthly payroll can prevent financial setbacks, keep your business legally compliant, and more. Compared to a bi-weekly payroll, semi-monthly has significantly fewer pay periods.

Semi-monthly Payroll Example

Before zeroing in on your pay schedule, here are some factors that you must consider while evaluating your options. But what about when you’re at the mercy of English as it’s wielded by others? For, as anyone who pays attention to our work surely recognizes, we are at the mercy of the language. Biweekly and bimonthly each have a pair of meanings that are unhelpfully at odds with one another. Although more paychecks may be a pro to some, the drawback of the checks being smaller may be a con to others.

One of the checks will be received in mid-month and the second check will arrive either at the beginning of the next month or on the last day of the current month. Usually, such payments are done on either the 1st or 15th day of the month or on the 15th and the final day of the month. A semi-monthly pay schedule means pay checks are distributed two times a month, usually on fixed dates such as the 1st and 15th, or the 15th and 30th. However, they may not necessarily fall on the same day of the week, and you would end up paying your employees 24 times in a year instead of 26. There are some important differences when it comes to semi-monthly vs. biweekly payroll. Let’s first look at the unique attributes and benefits of the biweekly pay schedule.

If a payday falls on a federal holiday, or weekend, the payday will need to be pushed up. Meaning employees will need to keep this in mind ahead of time. Biweekly payroll is the practice of distributing paychecks on the same day every other week. Say the pay periods in a month are the 1st through the 15th and the 16th through the last day of the month. The difference between ‘semi-monthly’ and ‘bi-weekly’ when it comes to payroll is that the number of checks you get is slightly different.

What Is a Biweekly Pay Schedule?

If you are a salaried employee, the payment schedule you receive may not change the amount you’re paid each paycheck. Paychecks on a biweekly pay schedule are paid out every other Friday. This means that your paycheck lands on the same day every time, unlike semimonthly. However, the days of the month vary, and even the number of times per month you get paid can change. A couple of months out of the year, you will get three paychecks as opposed to just two.

According to the Bureau of Labor Statistics, 36.5% of employees are paid biweekly. On the other hand, only 19.8% of employees are paid using the semimonthly payroll frequency. If you’re paid hourly for your work, your paychecks will be more random, regardless of the payment schedule you receive. This is especially true in the case of semimonthly pay, as the number of days between paychecks can have a substantial impact on the amount you’re paid.

Payroll Processing on an Hourly Basis

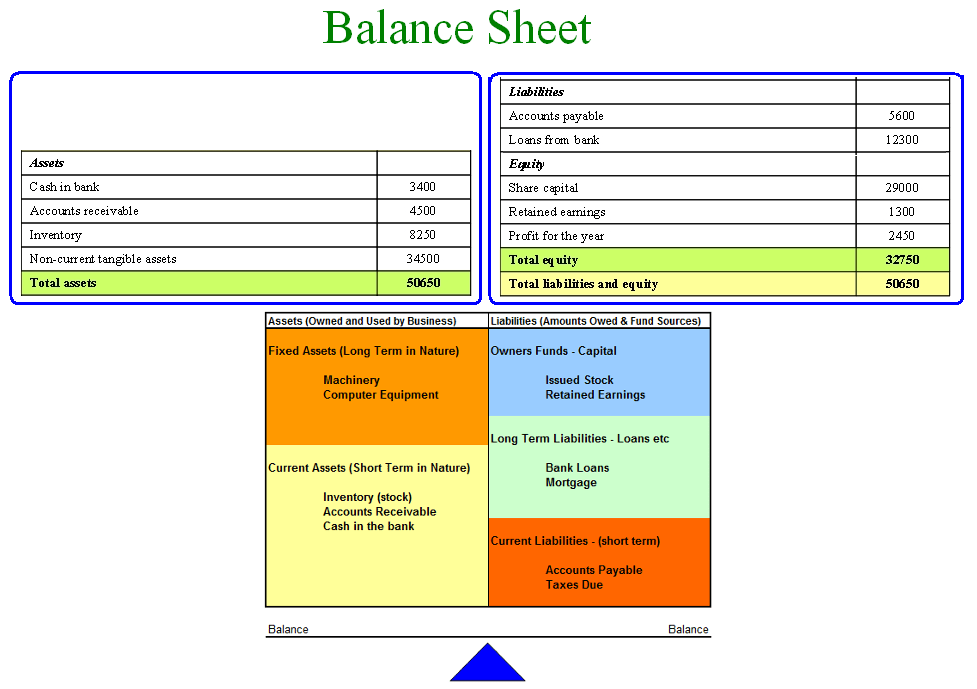

An employee earning $100,000 per year will receive 26 paychecks of $3,846.15, less taxes. When a business elects to use a semi-monthly pay schedule, its employees will get paid twice a month, or 24 times per year. In most instances, this will happen either on the 1st and 15th of every month or the 15th and last day (28th, 30th, or 31st) of every month. Semimonthly payments are most suitable for salaried employees who are on an organization’s permanent payroll and have little to no overtime in most cases. When discussing the semi-monthly vs bi-weekly payroll, it is important to check the pros and cons of the biweekly pay period as well. If you’re running payroll yourself, you’ll want to consider if you can run payroll weekly, biweekly, semimonthly, or monthly.

- For businesses, it can be less expensive to pay employees semi-monthly instead of bi-weekly.

- To combat this, you could run semimonthly payroll for salaried employees and biweekly for hourly workers.

- When paydays fall on holidays or weekends, employers may pay employees on the preceding Friday or workday.

- Running a semimonthly payroll for hourly employees is more difficult and confusing than doing so for salaried employees, especially when workers earn overtime pay.

- Getting invoices and source material, entering data, and printing and …

Bi-weekly and semi-monthly pay are similar, but there are three key differences. Only 19.8% of employees, on the other hand, are paid on a semimonthly basis. Workers will be given their salaries every other Friday if the selected payday is Friday, for a total of 26 paychecks throughout the year. From an employers perspective, semi-monthly is preferable since there are two less paychecks per year for the company to prepare making it more efficient.

s of companies are using Tapcheck

Biweekly pay and semimonthly pay can be confusing because employees generally receive two payments per month. However, there’s more to these pay periods than meets the eye. For businesses, it can be less expensive to pay employees semi-monthly instead of bi-weekly.

13 Superior Electronic Time Clock for 2023 – CitizenSide

13 Superior Electronic Time Clock for 2023.

Posted: Mon, 21 Aug 2023 21:06:23 GMT [source]

If an employee earns a fixed amount or is salaried, the pay check received will be of the same amount every time it is received. In the case of hourly pay, the amount in the paycheck may differ as it will be as per the number of hours worked in that specific pay cycle. According to the Bureau of Labor Statistics, 43% of employees are paid biweekly.

Opinions expressed on the pages of this website belong to the author and do not represent the views of companies whose products and services are being reviewed. You would think that since there are generally four weeks in every month, these would equal the same thing. Sign up to receive the FREE weekly GrammarBook.com E-Newsletter.

However, the percentage of employees who receive semimonthly paychecks in these fields is still lower than the percentage who receive biweekly ones. Generally speaking, the commonality of semimonthly pay tops out at around 30%, even in the industries where it’s most popular. Semimonthly pay schedules for hourly employees are more complex than biweekly schedules. Because semimonthly schedules can consist of 15 to 16 days, hourly employees may report different hours each cycle. Employers who pay semimonthly may provide a payroll calendar to notify employees of when their time cards are due and when they’ll be paid. Because of the number of paydays, semimonthly paychecks are larger than biweekly paychecks.

The only thing that matters here is the amount in the check and how frequently you get the same. Here are some of the benefits of bi-weekly and semi-monthly pay schedules so you can make an informed decision on which is right for you. Weekly payroll works best for hourly workers and employees with irregular schedules.

Therefore, there would be two months in a year with an “extra” paycheck. Before choosing, keep in mind that states regulate how often employees must be paid and some states may not allow ceretain pay frequencies. Businesses should check with their state before choosing how often to run payroll.

Payday

Naturally, a salaried paycheck will be less on average each biweekly payday, but each schedule’s totals will remain the same over the course of the year. The main difference will be how often you receive your paycheck. It is prudent to understand here that whether a salaried employee is paid biweekly and semi-monthly, it will leave no impact on the annual pay drawn by you. Regardless of the payment schedule, the employee will get the same amount annually.

If you’re paid hourly, each paycheck will be different since it will represent the number of hours you worked throughout that pay cycle, inclusive over time. For example, banks and other financial services industries often elect for monthly paychecks since people in this profession earn higher than average salaries. For industries that pay low hourly wages, such as food service, weekly paychecks are more common. As you can see, both payroll options come with their own pros and cons, which makes them suitable for different scenarios. That said, as a general rule of thumb, the semimonthly system is better for employers, whereas the biweekly one suits employees more.

On the other hand, only 19% of employees are paid using the semimonthly payroll frequency. The regularity with which your small business is paid is a critical decision. The period with which you execute payroll and when workers receive their paychecks is determined by your pay frequency. Semimonthly vs biweekly pay periods are two popular, yet frequently mistaken with each other. Because the payroll is processed fewer times for semimonthly frequencies than biweekly, employees’ paychecks will be greater. Biweekly paychecks will be be for less money, but employees will receive the two additional paychecks to make up the difference.

Because of the set dates, payday can happen on any day of the week. When paydays fall on holidays or weekends, employers may pay employees Semimonthly vs biweekly on the preceding Friday or workday. A semi-monthly payroll schedule pays employees twice a month, totaling 24 cheques for the whole year.

Now let’s assume that another company pays its employees semimonthly on the 15th day and the last day of every month. If it hires a new employee at an annual salary of $52,000 the employee will be earning $2,166.67 ($52,000 divided by 24 paydays) during each semimonthly pay period. The employee’s pay records will indicate a gross salary of $2,166.67 each semimonthly payday.

Recent Comments